Simplify and Automate Your Marketing Compliance

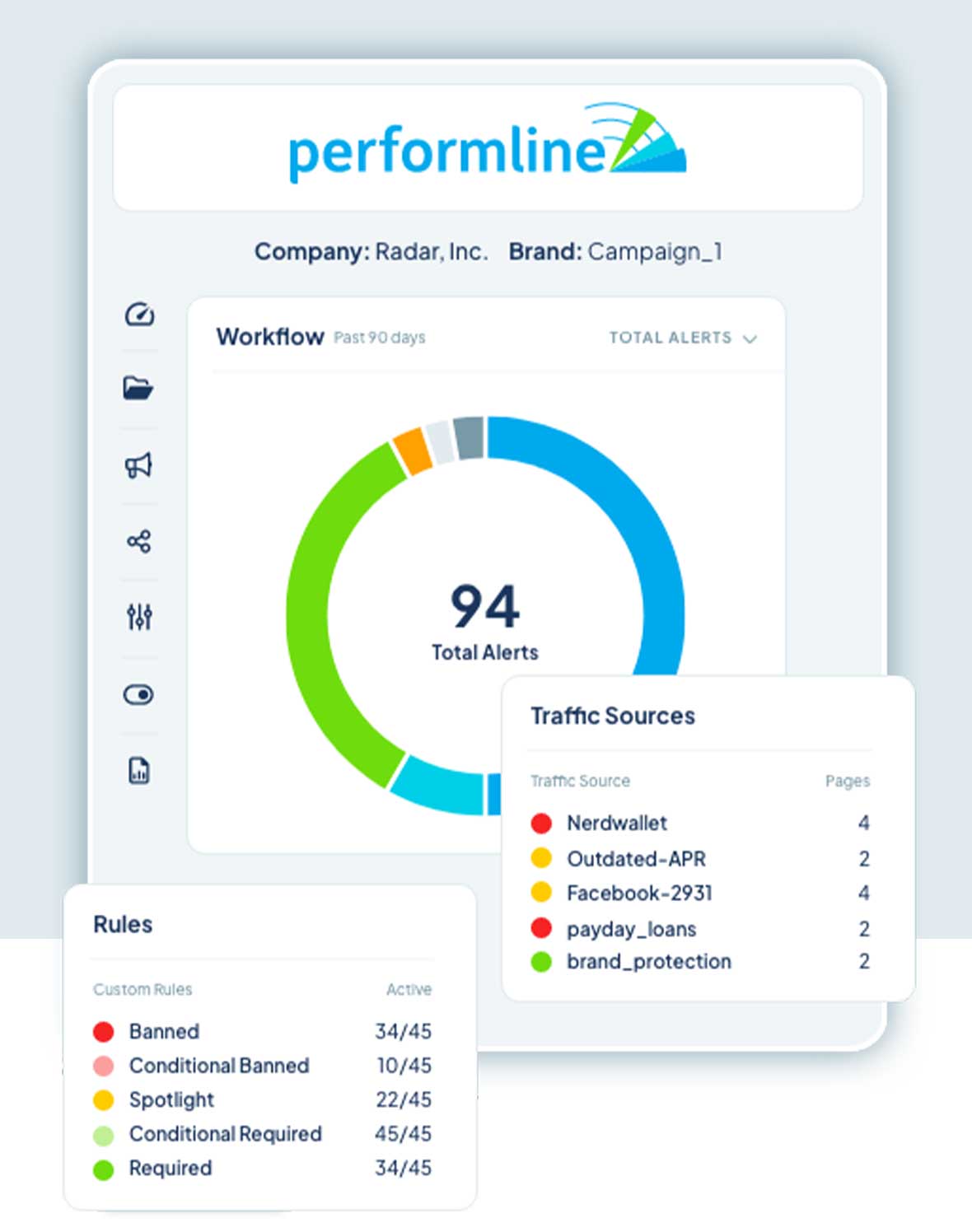

Easily monitor, detect, and resolve compliance issues across all marketing channels.

- 60x More Oversight across all marketing channels with dozens of direct integrations with your tech stack

- Save 1,000+ Hours Each Month of manual review using our AI-powered monitoring tools

- 57% increase in compliance oversight of web pages monitored that were previously unknown and discovered by PerformLine.

Request a demo

Unified Platform for Marketing and Sales Oversight

One Powerful Platform

Our web, call, messaging, email, document, and social media compliance monitoring are powerful alone—but invincible when used together

Future-Proof Compliance

Monitor all marketing and sales activities for compliance in one platform that evolves as regulations do

Scale When You Need It

Centralized and scalable to grow with your organization across departments, channels, products, partners, and reps

Why PerformLine?

Find the vanity URLs, emails, and social media posts made by loan officers to ensure compliant promotion.

Public use information obtained from NMLS® Consumer AccessSM for fast and easy onboarding and continually updated Loan Officer review.

Onboard more loan officers and increase new product GTM speed using compliance tech that scales internally and across marketing channels.

Demonstrate a commitment to marketing compliance and consumer protection with always-on discovery and monitoring.

Maximize time and cost savings by consolidating compliance efforts into one comprehensive platform.

Demonstrate to regulators that you’re taking the necessary steps to ensure compliance with a complete history of discovery through remediation for any audit situation.

How a major loan provider monitors 250+ partners for marketing compliance using PerformLine

“Compared to reviewing an item manually, items that are compliant get an approval response in less than five minutes with no human intervention required.”